Real Estate contributes 40% of global emissions.

Decarbonising real estate requires $18 tn of investment.

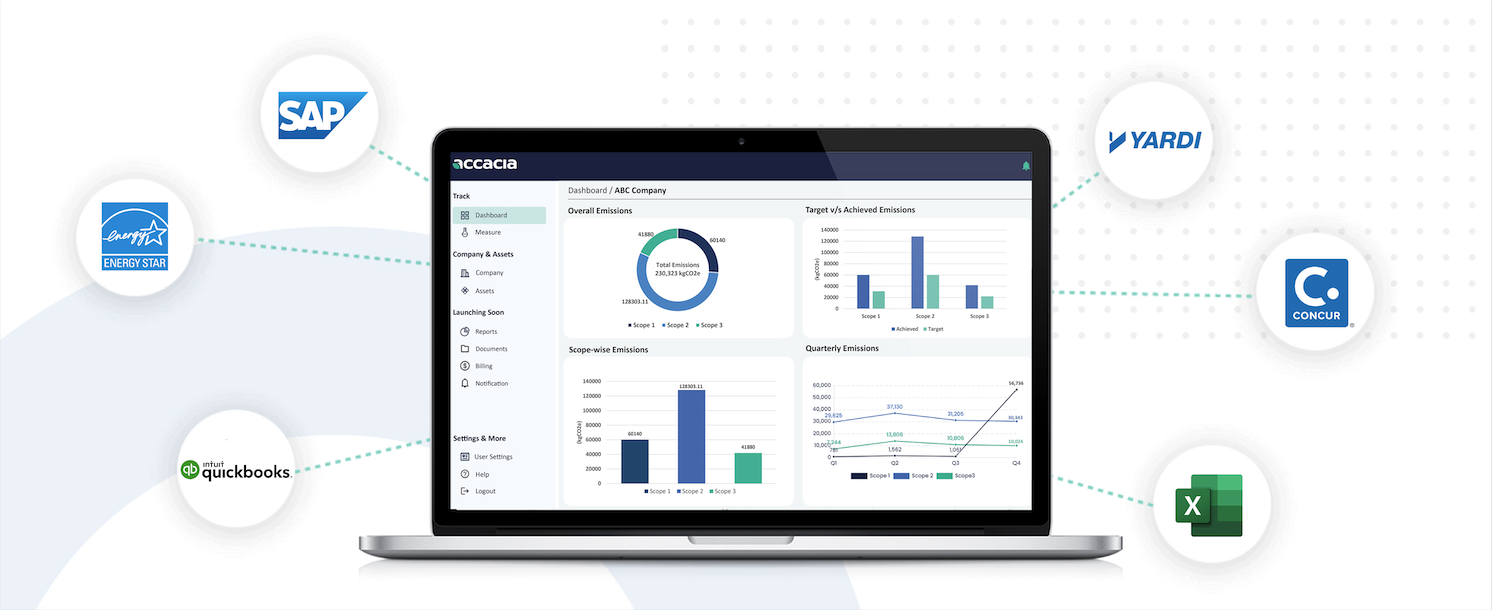

Real Estate Decarbonisation Platform

An AI-enabled platform that allows RE and infrastructure owners, developers, asset managers, and operators to measure, track and manage their climate risks.

Operating Emissions

Embodied Carbon

Environmental Risks

Risk Management

Operating Emissions

About 70% of buildings’ emissions come from operations. Use our platform to seamlessly track your Scope 1, 2 and 3 emissions and allocate emissions to different stakeholders including owners, assist managers, operators, and debtors.

Why is it important to measure?

Robust Regulation and Legislation

Is driving a fundamental shift in the sector with major exchanges such as the SEC requiring listed companies to disclose carbon footprint.

Increased Occupancy and Higher Rents

Green buildings demand 5.6% higher rent than non-certified buildings while providing lower costs.

Lower Cost of Capital

87% increase in Green Bond Issuance in 2021 to Over $532B. WACC improvement with low-interest green financing which is amplified by current high-interest rate-environments.

Institutional Investor Pressure

Climate change's physical and transition risks touch every aspect of a building's operations and value. These changes add up to substantial valuation impacts for even diversified portfolios.

Meet the solution designed uniquely for RE and infrastructure

Learn more about solutions >

Asset-Level tracking to enable you to identify hot spots

Embodied carbon for new buildings and suppliers with EPD and GWP data

Scope 3 modules for all asset classes within RE

Largest Emission Factors' dataset for real estate industry

Physical risks to your portfolio

Benchmark against peers and other properties within your portfolio

Bring all your data together

and track emissions real-time

Asset Classes

Commercial Real Estate

Hotels

College Campuses

Financial Institutions

Warehouses

Data Centers

Infrastructure

Multi-family residential

Government buildings

Hospitals

Airports